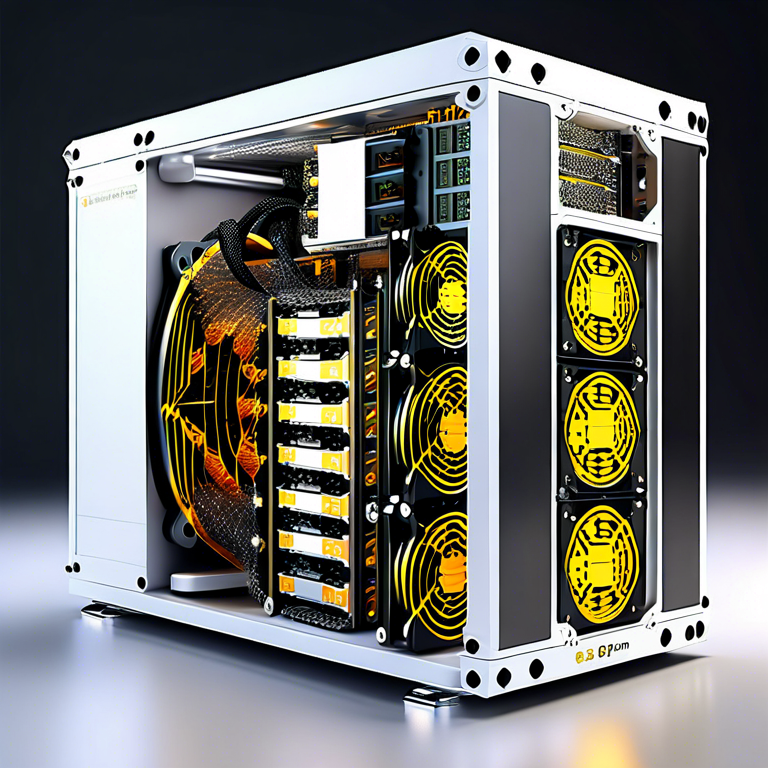

This article dives into the world of compact bitcoin mining rigs, also known as mini Bitcoin miners, exploring their pricing, benefits, and operational efficiency. By understanding these parameters, prospective miners can make informed decisions on initiating or expanding their cryptocurrency mining endeavors with these smaller, potentially more affordable units.

Key Factors Influencing Mini Bitcoin Miner Prices

The cost of compact Bitcoin mining hardware varies significantly based on several critical factors. These include the miner’s hash rate, energy efficiency, brand reputation, and the overall demand and supply dynamics in the cryptocurrency hardware market. As the blockchain technology landscape evolves, so too does the pricing of the hardware required to profitably mine Bitcoin and other cryptocurrencies.

Generally, mini Bitcoin miners offer a more cost-effective entry point into the mining scene. These devices are designed for enthusiasts, small-scale operations, or those just starting with cryptocurrency mining. Despite their smaller size and often lower hash rate compared to full-sized rigs, they present an appealing balance between price and performance for many users.

Exploring the Price Range of Mini Bitcoin Miners

As of the latest market research, mini Bitcoin miners can range in price significantly. Entry-level models might be found for as little as a few hundred dollars, while more advanced units could cost upwards of a few thousand. The variability in price is often directly linked to the miner’s performance capabilities, namely its hash rate, which dictates how quickly it can solve the complex mathematical puzzles required to mine Bitcoin.

For instance, a mini mining rig with a hash rate of around 10 TH/s (terra hashes per second) might be found on the lower end of the price spectrum. These units are suitable for those looking to dip their toes into mining without significant initial investment. Conversely, higher-end models boasting hash rates of 30 TH/s or more will naturally come at a higher cost, reflecting their increased earning potential through mining activities.

Cost vs. Efficiency: Making an Informed Decision

When considering the purchase of a mini Bitcoin miner, one must weigh the initial cost against the operational efficiency and potential return on investment (ROI). Energy consumption is a crucial factor here; a more energy-efficient miner will often result in lower ongoing expenses, thereby improving profitability over time. It’s also essential to consider the miner’s durability and the manufacturer’s customer support quality, as these can impact long-term satisfaction and effectiveness.

Furthermore, prospective buyers should stay informed about the ever-changing landscape of cryptocurrency legislation, as shifts in regulatory frameworks can profoundly affect mining profitability. Keeping an eye on Bitcoin’s market price is equally important, as higher cryptocurrency values can significantly amplify mining rewards.

In conclusion, while mini Bitcoin miners present a more accessible option for individuals looking to embark on or expand their mining projects, careful consideration of the price, efficiency, and broader market dynamics is essential. By doing so, miners can position themselves better to achieve desirable outcomes in the vibrant and unpredictable world of cryptocurrency mining.