In the rapidly evolving world of cryptocurrency, Ethereum stands as a cornerstone for both investors and technology enthusiasts alike. With the surge in Ethereum mining, the interest in efficient and powerful mining hardware, specifically ASIC miners, has skyrocketed. This article delves into the world of Ethereum ASIC miners, offering a comprehensive guide to their pricing, performance, and where to find them. By the end of this exploration, readers will have a nuanced understanding of Ethereum ASIC miner costs and the factors influencing their market value.

Understanding Ethereum Mining

Before diving into the specifics of ASIC mining for Ethereum, it’s crucial to understand what Ethereum mining entails. Ethereum mining is the process by which transactions on the Ethereum network are verified and added to the blockchain, the underlying technology of Ethereum. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with Ethereum. This process not only secures the network but also creates new Ethereum tokens, contributing to the circulating supply.

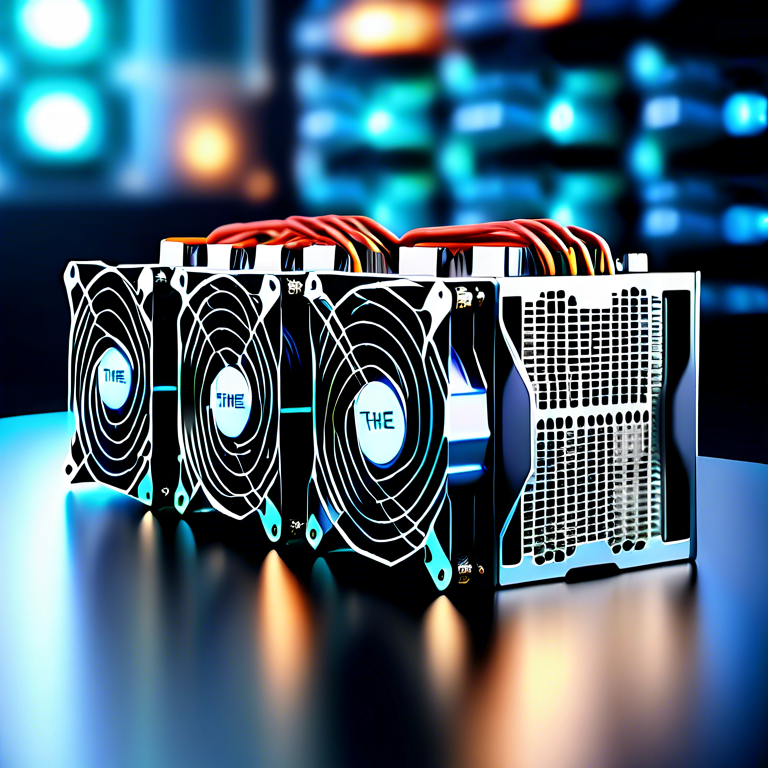

Traditionally, Ethereum mining was dominated by graphics processing units (GPUs) due to their computational efficiency and availability. However, with the advent of Application-Specific Integrated Circuit (ASIC) miners designed solely for cryptocurrency mining, the landscape has shifted. ASIC miners offer unparalleled performance and energy efficiency, making them highly sought after in the Ethereum mining community.

Ethereum ASIC Miner: Price Factors

The cost of Ethereum ASIC miners is influenced by several key factors, from manufacturing complexity to market demand. An ASIC miner’s price can range significantly, based on its hash rate (the speed at which it can mine

), energy efficiency, and durability.

Market demand plays a significant role in the pricing of ASIC miners. With the increasing popularity of Ethereum, the demand for efficient mining hardware has surged, often outstripping supply. This demand can drive prices up, especially for top-of-the-line models that promise high hash rates and low electricity consumption.

Another critical factor is the ongoing development within the Ethereum network itself, notably the transition to Ethereum 2.

0, which aims to shift from proof-of-work (mining) to proof-of-stake. This transition could potentially affect the long-term demand and pricing of Ethereum mining hardware, including ASIC miners.

Current Market Prices

As of the latest market analysis, Ethereum ASIC miner prices can vary widely, starting from a few hundred dollars to several thousand dollars. Entry-level miners may be available at lower price points, but for serious miners looking for optimal performance, the investment can be substantial.

High-end ASIC miners can command prices upwards of

$5,00

0, depending on their hash rate and energy efficiency. It’s worth noting that prices are subject to change due to the volatile nature of the cryptocurrency market, as well as technological advancements that may introduce more efficient or powerful miners to the market.

Conclusion

Investing in an Ethereum ASIC miner is a significant decision that requires careful consideration of the miner’s cost, performance, and the current state of the Ethereum network. With the anticipated shift to Ethereum 2.

0, potential buyers should also consider the longevity and future relevance of their investment. By staying informed and carefully evaluating the available options, miners can select an ASIC miner that offers the best value and performance for their specific needs.

In conclusion, while the cost of Ethereum ASIC miners may vary, understanding the factors that influence their price can help potential buyers make informed decisions. Whether you are a seasoned miner or new to the Ethereum mining scene, the key to success is in-depth research and strategic investment in hardware that meets your mining goals and budget.